carbon tax vs cap and trade pros and cons

Those supporting a carbon tax argue that it is a better approach because it is. Taken where we have discussed cap trade vs.

Should The Us Implement A Carbon Cap And Trade System Alternative Energy Procon Org

Comparison of Carbon Tax and Cap.

. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so. Several analyses have claimed that a carbon tax is superior to cap and trade in terms of the ability to achieve a fair distribution of the policy burden between polluters firms and consumers to preserve international competitiveness or to avoid problems associated with. Simply put the less fossil fuel used the less the tax affects the company.

A price on carbon can also be implemented via cap-and-trade programs which limit the total quantity of emissions per year. Carbon sequestration commonly occurs in agriculture via an increase in. A carbon tax has a major advantage over cap-and-trade and a hybrid version because it allows for carbon price certainty is less costly to administer and is a substantial source of revenue.

Carbon taxes vs. Essentially a carbon tax sets a fixed price for carbon emissions while the ETS sets a fixed quantity of emissions. A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources.

Cap-and-trade sets the quantity of emissions reductions and lets the. Although cap-and-trade is the most cost-efficient option for firms more revenue from a carbon tax system can be used by the government to fund spending or reduce other taxes. Entities that have an overall increase in sequestered carbon may be eligible to sell the extra as carbon credit trade.

One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. However they do it in slightly different ways. Although no option dominates the others a key finding is that exogenous emissions pricing whether through a carbon tax or through the hybrid option has a number of important attractions over pure cap and trade.

Both measures are attempts to reduce environmental damage without causing undue economic hardship to the industry. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is politically more attractive. The downside is that you need to guess how high to.

A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. This can be implemented either through a carbon tax known as a. A carbon tax is a simpler blunter tool which is easier to administer and regulate.

Each approach has its vocal supporters. November 2019 Paper There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential element of any national policy that can achieve meaningful reductions of CO2 emissions costeffectively in the United States and many other countries. A government entity sets a limit cap on the amount of a pollutant such as carbon dioxide or another greenhouse gas.

Cap and trade. Carbon taxes would directly establish a price on carbon in dollars per ton of emissions. Comparison of Carbon Tax and Cap Trade.

Theory and practice Robert N. Proponents of cap and trade argue that it is a palatable alternative to a carbon tax. I believe both systems have their merits and utilizing either one would positively affect climate change and the economy.

Economists love discussing the pros and cons of a carbon tax versus the cap-and-trade system. With a carbon tax there is an immediate cost to firms for polluting. A carbon tax is sort of the opposite.

Beyond helping prevent price volatility and reducing expected policy errors in the face of uncertainties exogenous pricing helps avoid. However a cap-and-trade policy offers its own advantages in that emissions allowances can be allocated so as to minimize the policys negative effects on competitiveness and prevent. Now that weve explored both the option of implementing a carbon tax for emissions or regulating them under a cap and trade scheme lets take a closer look at what the differences are.

Carbon taxes and cap-and-trade schemes are two ways to put a price on carbon pollution each with its own pros and cons Skip to. There are two primary methods of pricing carbon-carbon taxes and cap-and-trade programs. There is no cap on emissions in a.

Both the carbon tax and the ETS reduce emissions by putting a cost on carbon emissions. I believe carbon taxes are the better of the two options because it is simple and immediately causes companies and individuals of ways to reduce fuel and energy consumption. I believe carbon taxes are the better of the two options because it is simple and immediately causes companies and individuals of ways to reduce fuel and energy consumption.

A cost is added to all emissions equal to the level of the tax and this causes people to cut back.

Cap And Trade Vs Carbon Tax Youtube

Carbon Tax Pros And Cons Economics Help

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Carbon Taxes And Cap And Trade State Policy Options Muninet Guide

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

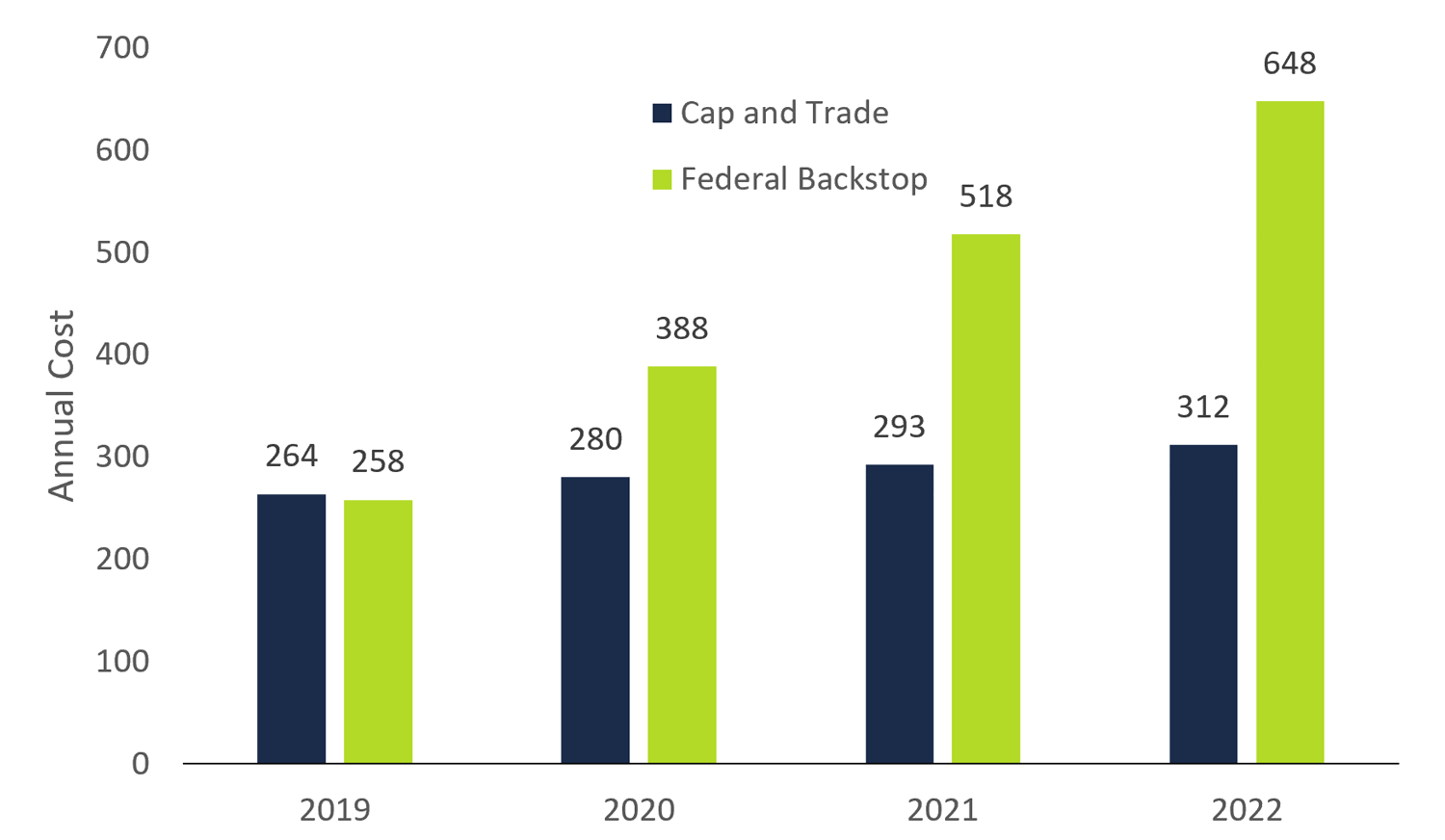

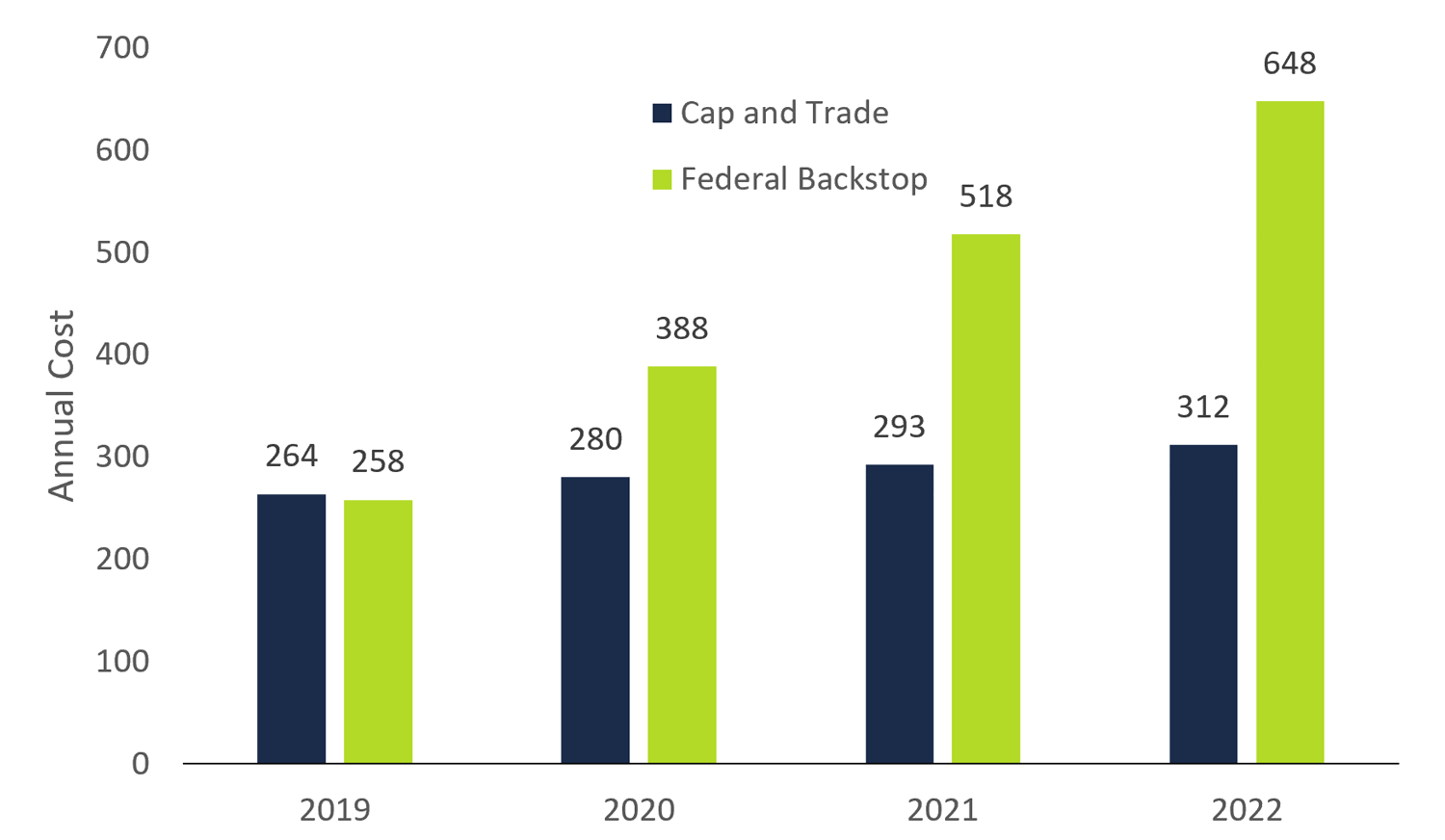

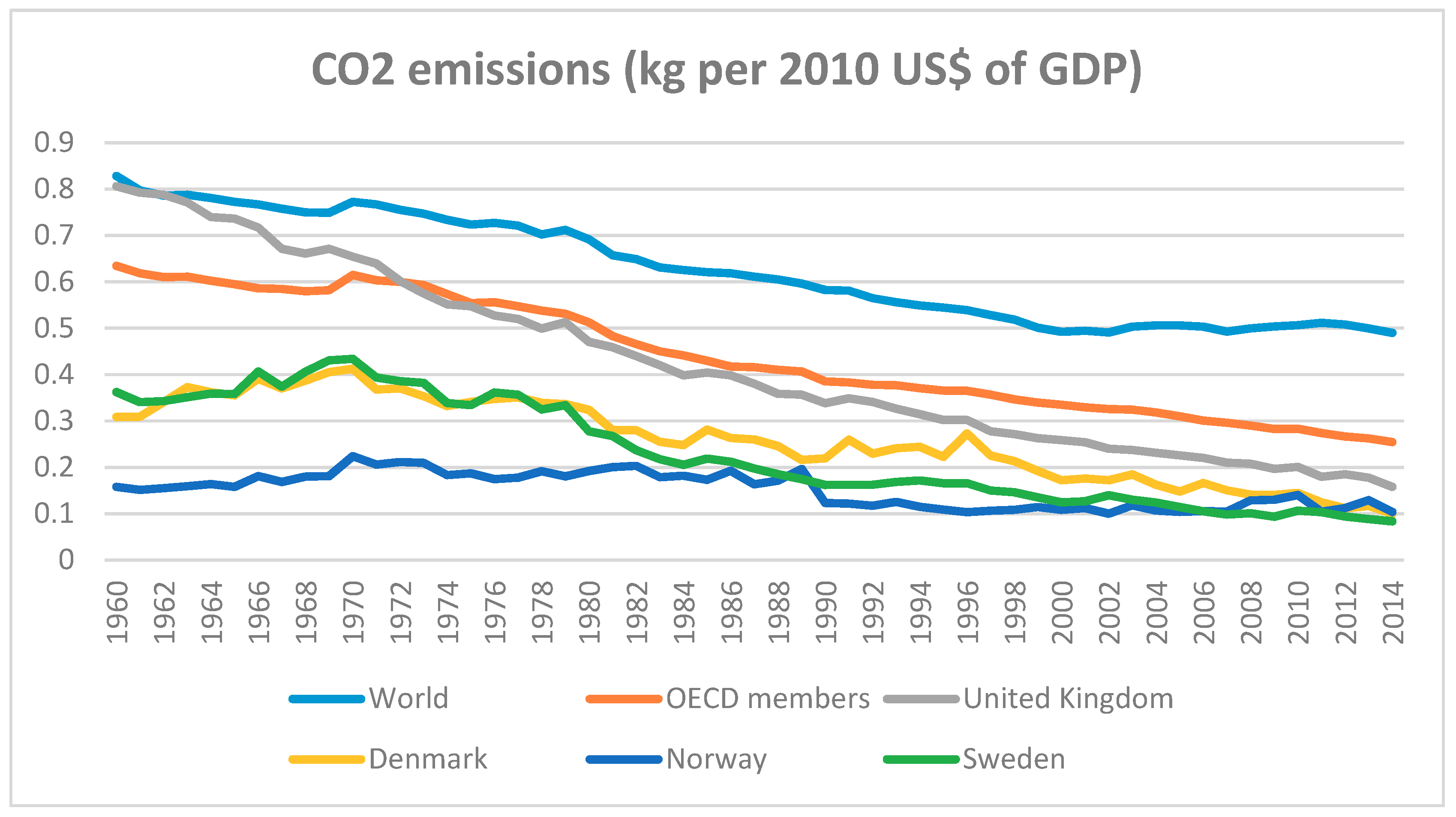

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

27 Main Pros Cons Of Carbon Taxes E C

Cap And Trade Vs Carbon Tax Earth Org Past Present Future

Carbon Co2 Emissions Tax Explained Pros Cons Alternatives

Carbon Tax Vs Cap And Trade Which Is Better R Economics

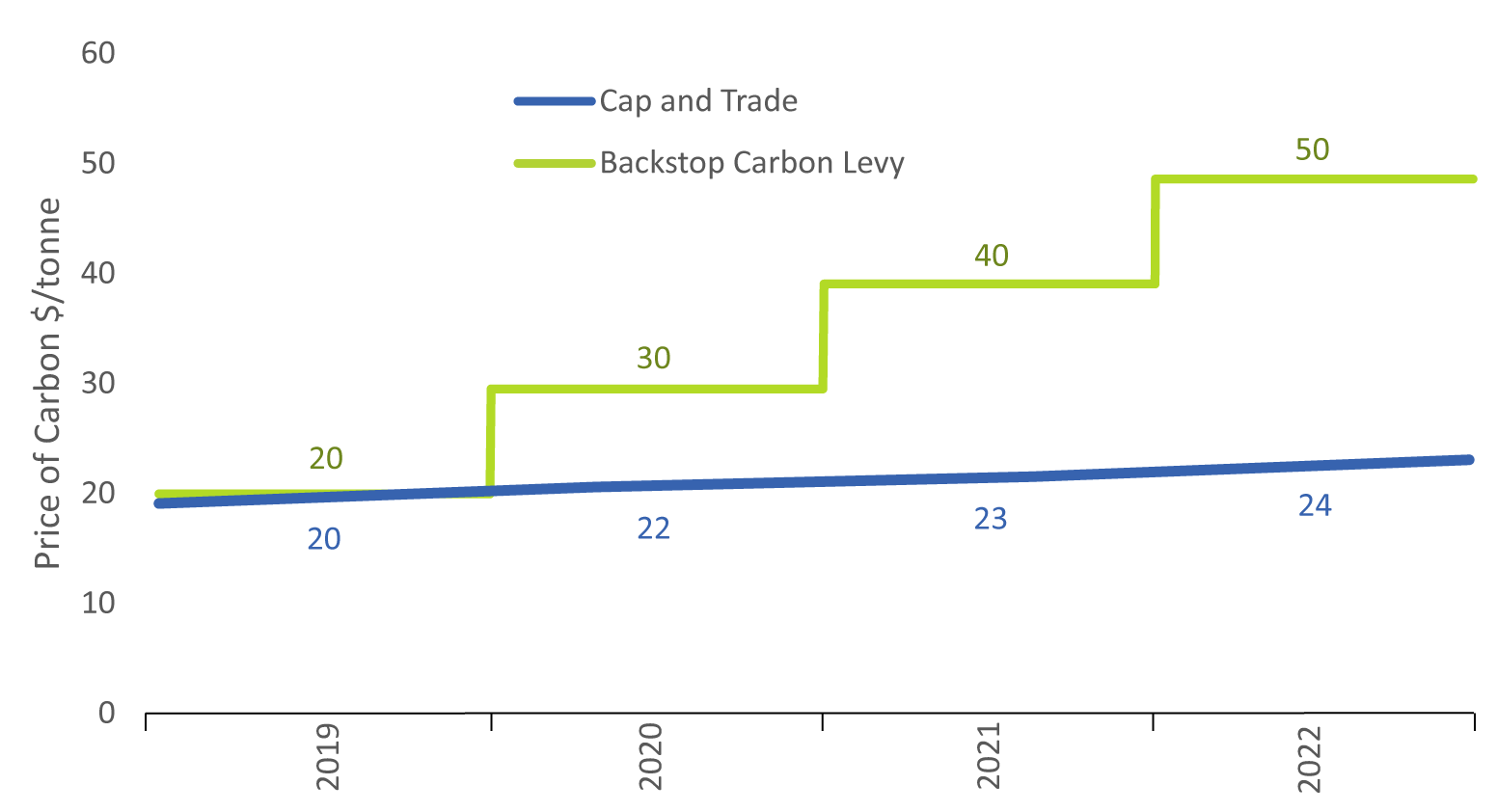

Sustainability Free Full Text Carbon Taxation A Tale Of Three Countries Html

Carbon Tax Pros And Cons Economics Help

Seneca Esg Pricing Carbon Emissions Trading Schemes Part 1

Factbox Carbon Offset Credits And Their Pros And Cons Reuters